We Help Our Clients Formulate BioBased Products That Qualify For Mandatory Procurement Programs And Meet Tightening Regulatory Requirements

Click here to request sample materialsOur BioBased Materials and Chemicals Solve the “Iron Triangle of Sustainability”

When selecting materials for building and infrastructure projects, stakeholders consistently encounter an inherent set of trade-offs. Most project managers are familiar with the famous Iron Triangle – Good, Fast, and Cheap.

However, when switching to BioBased products, product managers now have to content with an additional set of considerations we call the Iron Triangle of Sustainability: Performance, Toxicity, and Cost.

Traditionally, high-performance materials—such as protective coatings, sealants, lubricants, and concrete additives—have relied on chemical formulations posing significant environmental and health hazards.

Conversely, safer bio-based or non-toxic alternatives often struggle to match the performance standards required in rigorous environments, particularly those demanded by military applications. Such alternatives also tend to carry higher upfront costs, further complicating their widespread adoption.

Today, intensifying regulatory requirements and environmental mandates are significantly increasing the urgency to resolve this sustainability dilemma. Environmental policies and specific Department of Defense (DoD) directives are actively phasing out toxic legacy materials, driving demand for innovative solutions.

For example, Congress has mandated the U.S. Navy must phase out copper-based antifouling coatings by 2028. This regulatory directive explicitly demands new coatings that match existing fouling prevention performance, minimize environmental impact (particularly copper leaching), and deliver improved fuel efficiency, effectively requiring innovation that simultaneously meets both environmental and performance standards.

The initiative also requests a corresponding evaluation of biological adhesion, corrosion, and degradation to the craft, environmental harm caused by shedding and leaching of coating, and effects on fuel efficiency and speed.

This is projected to result in growing demand for antifouling paints and coatings.

According to the UNCTAD Handbook of Statistics 2023, the total world fleet accounted for an overall carrying capacity of 2.3 billion dead weight tons (dwt) in 2023. This was identified as an increase of 70 million dwt compared to 2022.

With growing concerns regarding the unceasing rise in fuel costs and stringent regulations closing upon fleet maintenance and management, every business in the industry is seeking solutions to reduce expenditure and enhance the performance of vessels.

Biofouling can increase fuel consumption by up to 40%, translating to roughly a billion dollars annually across the maritime industry.

Traditional methods use biocidal antifouling coatings that release toxins to kill organisms, while more recent innovations focus on fouling-release coatings, which make surfaces less attractive to organisms or easier for them to detach. These coatings may help reduce drag, improve fuel efficiency, and minimize the need for expensive hull cleaning.

Wood tar from pyrolysis, especially when combined with modern bio-based or nanotechnology enhancements, offers a promising path toward high-performance, low-toxicity antifouling solutions that align with emerging regulations and sustainability demands

Tar is a sticky black substance that has been used for centuries in construction, waterproofing, road paving, and even medicinal applications.

Wood tar remains highly valued in marine applications, continuing its centuries-old tradition:

Boat Hull Protection: Pine tar (often called Stockholm Tar) is still used to protect wooden boat hulls from water damage, providing superior moisture resistance and natural preservation. The material penetrates deeply into wood fibers, creating a water-repellent barrier that allows the wood to breathe while preventing rot.

Rope and Cordage Treatment: Traditional hemp ropes and natural fibers used in marine applications are treated with pine tar to increase their durability and resistance to water damage

Wooden Marine Structures: Docks, piers, and other wooden structures exposed to water are treated with wood tar to extend their service life and protect against marine organisms.

Wood tar remains highly valued in marine applications, continuing its centuries-old tradition:

Exterior Wood Preservation: In Scandinavia and increasingly in North America, tar is used as a natural preservative for wooden siding, shingles, fences, and outdoor structures. It provides excellent protection against moisture, UV radiation, and biological degradation

Timber Frame and Log Buildings: Traditional wooden structures benefit from wood tar treatments that protect against weathering while maintaining the natural character of the wood

Fence Posts and Garden Structures: Tar is used to treat wood that comes in contact with soil, providing a natural alternative to pressure-treated lumber containing synthetic chemicals

Wood Vinegar: An Organic Pesticide and Fungicide with Agricultural and Industrial Use Cases

Wood vinegar products have demonstrated strong interest from agricultural customers seeking organic-certified soil amendments and pest management solutions. The company is currently testing wood vinegar products as BioFungicide / BioPesticide additive to fruit-bearing tree management.

Wood vinegar, also known as pyroligneous acid, is the secondary product of biomass pyrolysis that is a natural by-product of biomass pyrolysis and has many uses. In the sector of agriculture, wood vinegar is a natural insecticide and soil condition that promotes microbial activity and prevents the use of synthetic chemicals.

The development of wood vinegar is fueled mainly by the increasing application of it in environmental control, organic and natural products, regulatory frameworks, and new farming, food preservation, and animal feeding technologies.

Apart from agricultural benefits, its antimicrobial and antioxidant properties are reasons why it is used in food preservation, cosmetics, and pharmaceuticals, thus associating with the trend of organic and natural products.

Apart from agricultural benefits, its antimicrobial and antioxidant properties are reasons why it is used in food preservation, cosmetics, and pharmaceuticals, thus associating with the trend of organic and natural products.

OMRI Certified Organic Agricultural Markets present significant scalability with $8-15 per liter compared to basic agricultural applications at $2-5/L. This segment targets the 4.9 million certified organic acres operated by 17,445 farms nationwide.

Apart from agricultural benefits, its antimicrobial and antioxidant properties are reasons why it is used in food preservation, cosmetics, and pharmaceuticals, thus associating with the trend of organic and natural products.

Washington’s Tree Fruit Dominance Creates Prime Biofungicide Market

According to The U.S. Department of Agriculture’s National Agricultural Statistics Service (NASS), Washington State ranks second nationally in organic sales with $1.14 billion, following California's $3.55 billion. Washington's organic sector benefits from 371 certified organic farms operating across 145,237 acres, creating substantial demand for approved organic inputs.

This concentration of high-value tree fruit production creates substantial demand for specialized crop protection solutions. Washington's high-value crops experience significant disease challenges that conventional fungicides struggle to address sustainably.

Apple production faces multiple fungal threats including apple scab, anthracnose, and Bull's eye rot, with postharvest diseases costing the industry millions annually.

The state's hop industry, representing 25% of worldwide production, confronts powdery mildew and downy mildew infections that can reduce yields by 50-75% and significantly impact alpha-acid content.

Wine grape production faces virus diseases and nematode-transmitted infections requiring careful management.

These disease pressures create a $65 million market opportunity for effective bio-fungicides that can address pathogen resistance while meeting organic certification requirements.

Wood vinegar's proven antimicrobial properties against bacterial and fungal pathogens, combined with its OMRI certification potential, position it as an ideal solution for Pacific Northwest agriculture.

How BioCarbon Black Can Reduce Plastic Usage And Reduce Microplastic Pollution

UV degradation is the cause of microplastic pollution – a significant threat to the environment and human health that we have no real solutions for today.

All materials absorb sunlight radiation – it’s what makes them heat up in the sunshine. While this isn’t normally something to be concerned with, when it comes to plastics, it’s a major problem.

But what if you could make black plastic that was highly UV resistant, effectively preventing microplastic pollution?

Enter: Carbon black – a pigment, conductive filler material, particulate reinforcement, and ultraviolet light (UV) absorber. Carbon black has proven to be the standard against which all other pigments and other UV absorbers are compared.

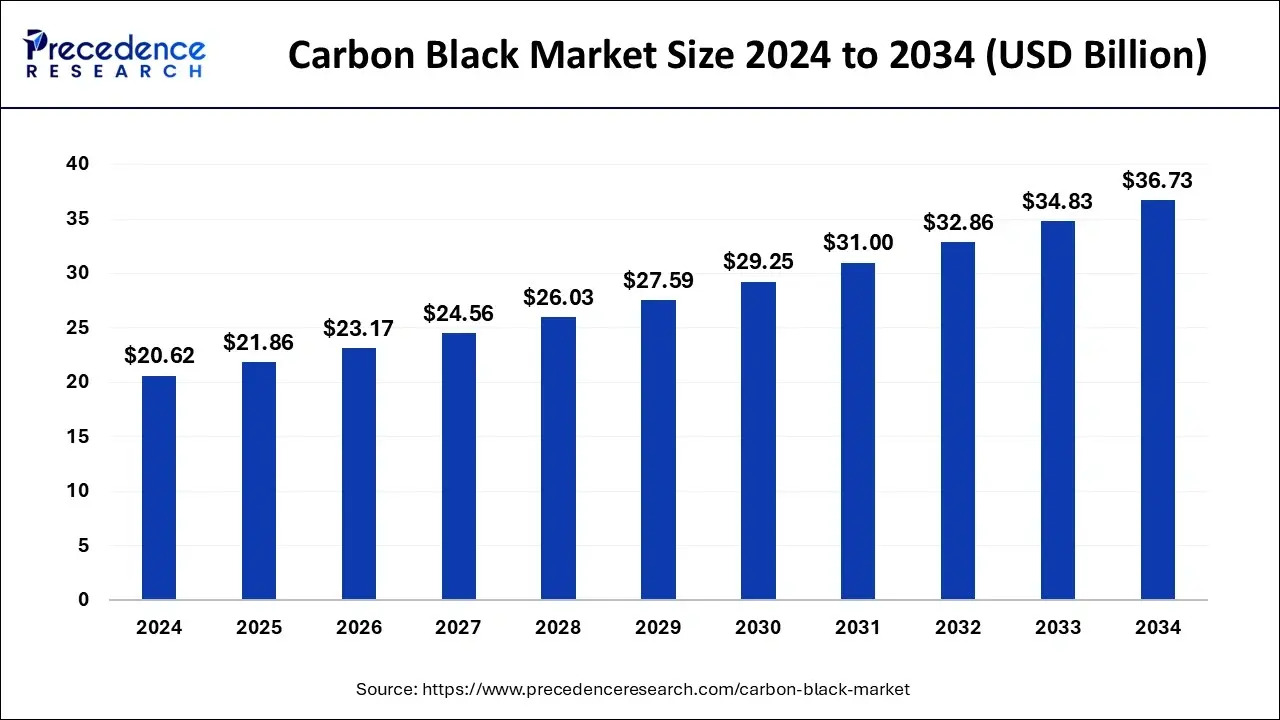

The global carbon black market is valued at ~$20.62 billion and is projected to reach $36.73 billion by 2033 – a compound annual growth rate of 6%

Traditionally, carbon used in products have been sourced from the petrochemicals industry, which accounts for 14% of oil production, equivalent to 12 million barrels per day, and 8% of gas production.

However, not all carbon black is created equal. The more milled, processed, purified, or packaged the carbon product is, the higher its unit value. Inversely, bulk agricultural or industrial-grade materials sold by the ton are priced for scalability and logistical efficiency.

We currently produce Micronized BioCarbon milled to 10-100 µm specifications, engineered to our clients needs

Micronized (or “specialty”) carbon black exhibits distinctive properties that differentiate it from conventional carbon black varieties. Its particle size and structure are meticulously engineered to meet precise specifications, ensuring optimal performance in end products.

The largest segment for specialty carbon black is the plastics industry. The fastest growing segment within the specialty carbon black market are Food Contact and Conductive applications.

Our clients are often looking to utilize our BioCarbon Black to create high value carbon black compounds that target high end applications – and secure this sustainable supply from domestic manufacturers.

Today, Asian producers dominate the development of specialty carbon blacks – grades characterized by ultra-low ash content, minimal PAHs, high purity, and tailored particle structures. This leadership emerged due to a combination of technology, market focus, and looser early regulations abroad.

U.S. import dependence in these high-end applications poses a significant strategic supply chain risk: any supply shock or export restriction from Asian suppliers could threaten hundreds of millions in downstream industries.

The U.S. effectively outsourced the “clean” carbon black segment, and is now exposed to environmental compliance issues and geopolitical supply risks that come with that dependency.

Carbon black produced from clean cellulosic feedstocks like wood waste or agricultural residues (“BioCarbon Black”) offers multiple advantages in meeting current and upcoming environmental and regulatory challenges. Key benefits include:

Ultra-Low Ash and Metal Content: Biomass-derived carbon tends to have extremely low inorganic content (ash), especially if made from clean wood or plant material. Unlike petroleum-derived carbon black, which can contain residual metals (vanadium, nickel, etc.) from crude oil, BioCarbon Black has negligible heavy metal impurities. This makes it ideal for high-purity applications (electronics, food packaging) where ash must be minimized.

Minimal PAH (Polycyclic Aromatic Hydrocarbon) Levels: PAHs are a byproduct of incomplete combustion of heavy hydrocarbons and are a concern in traditional furnace blacks. BioCarbon Black can be produced with very low PAH content because the feedstock is different (biomass pyrolysis oils have a different PAH profile than coal-tar oils) and the process can be optimized to burn off volatiles.

No PFAS and Fewer Contaminants: Using clean biomass and clean production processes ensures that PFAS or other synthetic contaminants are not introduced. A dedicated BioCarbon Black facility can avoid use of any fluorinated processing aids, and feedstocks like wood chips or nutshells generally contain no PFAS.

Lower Life-Cycle Carbon Emissions (Potential Carbon Neutrality): BioCarbon Black can have a dramatically smaller carbon footprint than traditional furnace black.

Performance Tailoring: Beyond environmental aspects, BioCarbon Black can be engineered for performance. By adjusting pyrolysis conditions, one can tune surface area, porosity, and structure.

The construction industry increasingly seeks eco-friendly materials, including bio-based polymers, as a renewable alternative to traditional plastics – ideal for pipes and insulation 2

With regulations tightening around energy conservation – as well as the prioritization of “green” certifications like LEED – we’re seeing a significant demand for bio-based polymers for their thermal properties to enhance energy efficiency in pipes and panels.

Globally, the bio-based construction polymer market reached approximately $13.49 billion in 2023 and is projected to grow at a robust compound annual growth rate (CAGR) of 14.8% from 2024 to 2030.

Manufacturers have increasingly utilized biomass, agricultural waste, and other renewable feedstocks as raw materials for bio-based polymers. This has aligned with sustainable construction practices, including green building solutions.

Click here to request samples of our Micronized Carbon Black